Home »

Manufacturing in India: Opportunities and Challenges

Contents

Manufacturing in India

The opportunity of manufacturing in India

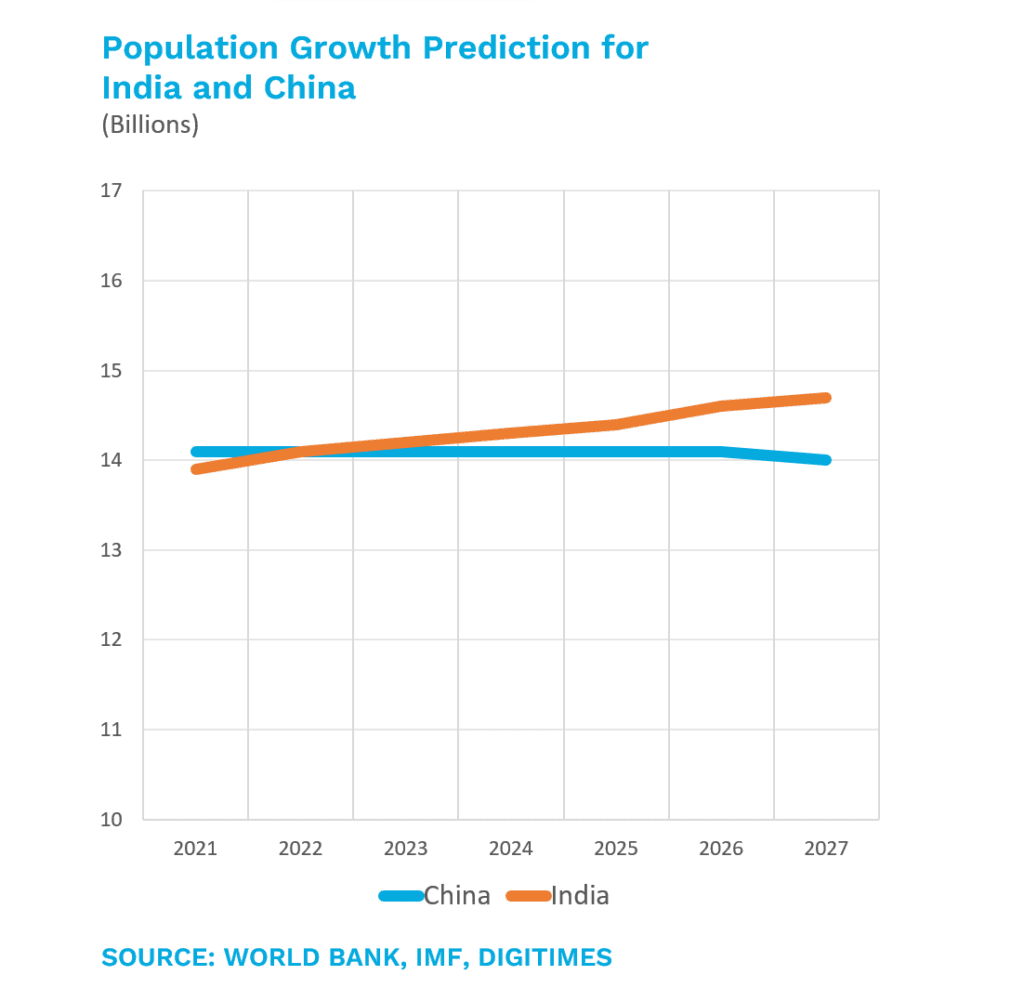

- Population Growth Prediction for India and China

- Consumer Electronics

- Semiconductor Products

- Electric Vehicles

Government programs to attract foreign investments

Understanding the legal, cultural and operational hurdles of doing business in India

There’s a better way

Right Partner Can Speed Your Expansion to India

MADE IN INDIA: Making it Happen

A practical guide to navigating the logistics, legal and trade compliance challenges of expanding manufacturing to India

Passage to India

More and more manufacturers are expanding production to India for its cost-effective and educated workforce, its attractive government incentive programs, and its massive consumer market. But companies often move too quickly, underestimating the complexity of customs, regulatory, logistics, and India manufacturing supply chain requirements. As a result, expansion projects can experience massive delays, added costs and damaged customer relationships.

While India is a great place to operate a production hub, it’s not an easy place establish a production hub.

The risks are greater for small and mid-sized manufacturers or enterprises that lack the internal staffs to manage this complexity. Don’t be in such a rush to reap the benefits of manufacturing in India that you stumble and fall in the process. It’s best to take the time to understand the requirements in detail to avoid inevitable delays and frustrations.

That doesn’t mean moving slowly, just judiciously.

In fact, we recommend a three-phase process for establishing a factory in India:

- Test the market

- Establish a trading company with a legal entity or a non-legal entity

that operates out of a Free Trade Warehousing Zone (FTWZ) - Operate your own factory

Instead of managing this approach on your own, consider working with an experienced logistics provider that truly understands the India market. The right partner will not only have the logistics know-how and infrastructure to store and distribute your products, they can advise on the legal and customs compliance side, as well.

In the end, you want to achieve fully compliant, hassle-free expansion to India. This eBook offers a path forward, looking at the upside opportunity of expansion, some of the potholes you’re likely to encounter and, ultimately, giving you a blueprint to make it happen.

Download Guide

If you prefer to download this article as a PDF, just complete the form. Otherwise, keep reading.

The opportunity of manufacturing in India

If you’re looking to establish manufacturing in India for the first time, you’re probably aware of some of the compelling demographic and financial advantages:

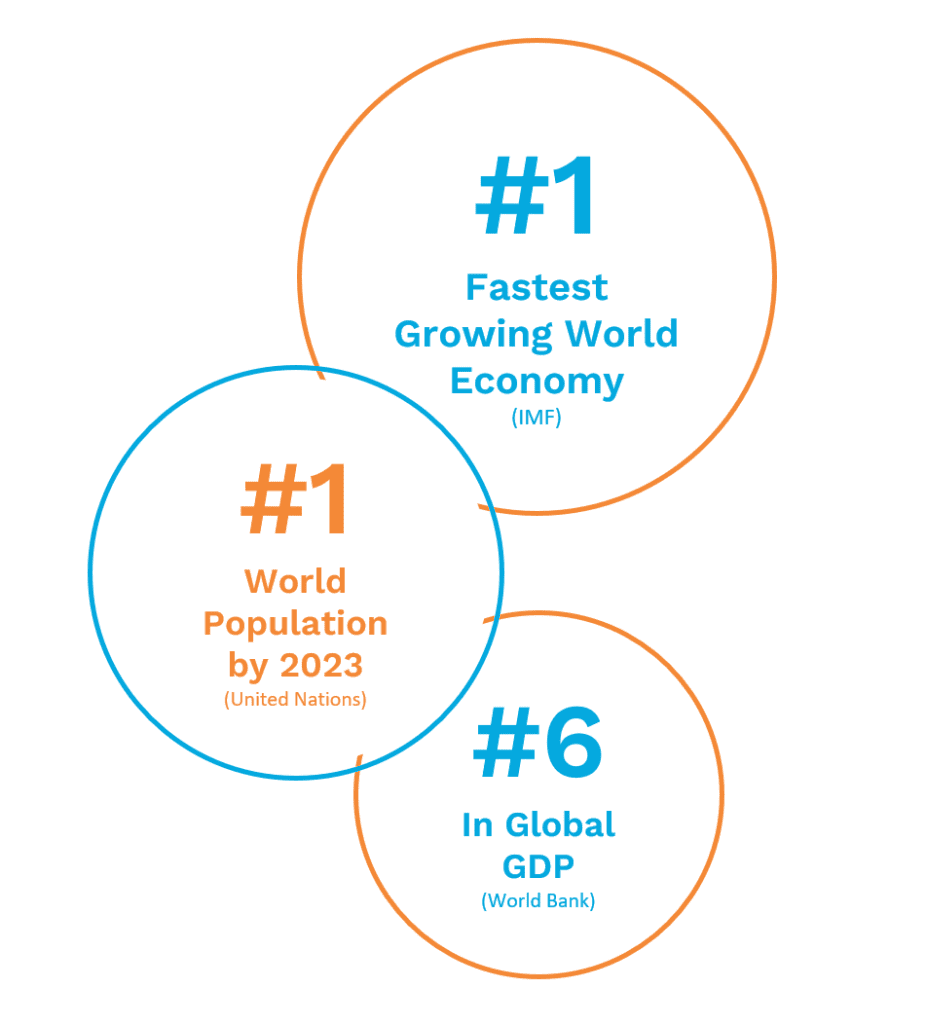

- World’s largest population. India surpassed China in 2023 to become the world’s most populous nation. Companies that manufacture in India will have a huge built-in market.

- Relatively low labor cost. According to the World Data, worker salary/income in India is 82% lower than China, 70% lower than Thailand, 49% lower than Indonesia, and 40% lower than both Vietnam and the Philippines.

- Strong labor availability. India has a large working-age population with a lot of engineers who are mostly bilingual.

India has certainly been a prime beneficiary of the China Plus One strategy, whereby manufacturers are decreasing their dependence on China for production and expanding elsewhere, particularly to Southeast Asia and India.

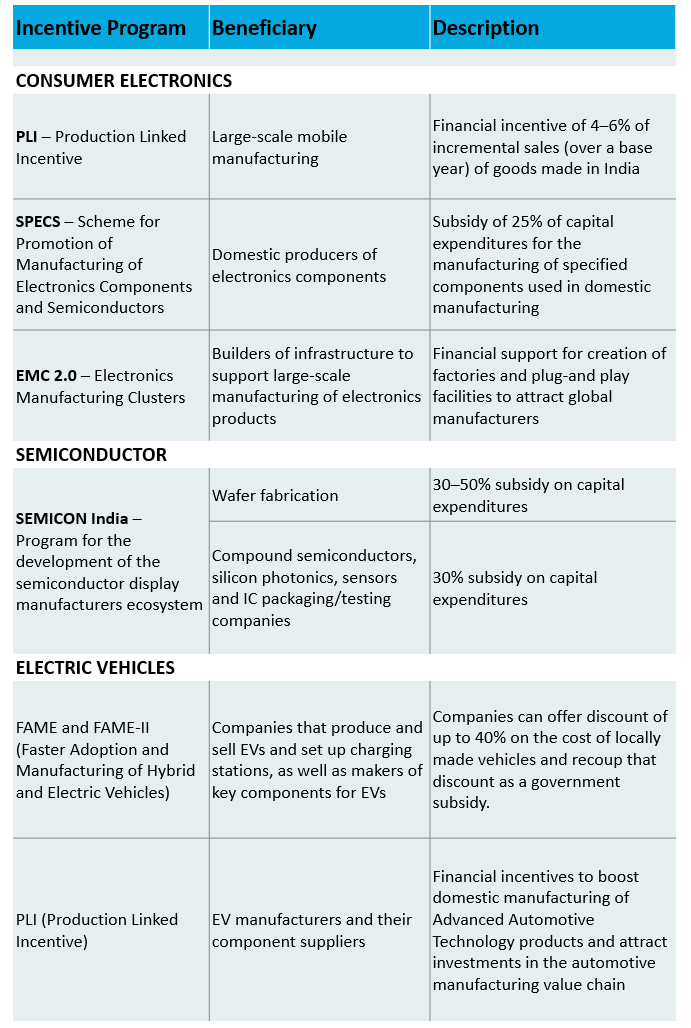

One of the challenges of the Indian government is providing jobs for its exploding population, so it’s made economic development a priority. Specifically, it’s invested heavily to attract companies in the consumer electronics, semiconductor and electric vehicle (EV) industries with Performance Linked Incentive schemes (PLI).

Consumer Electronics

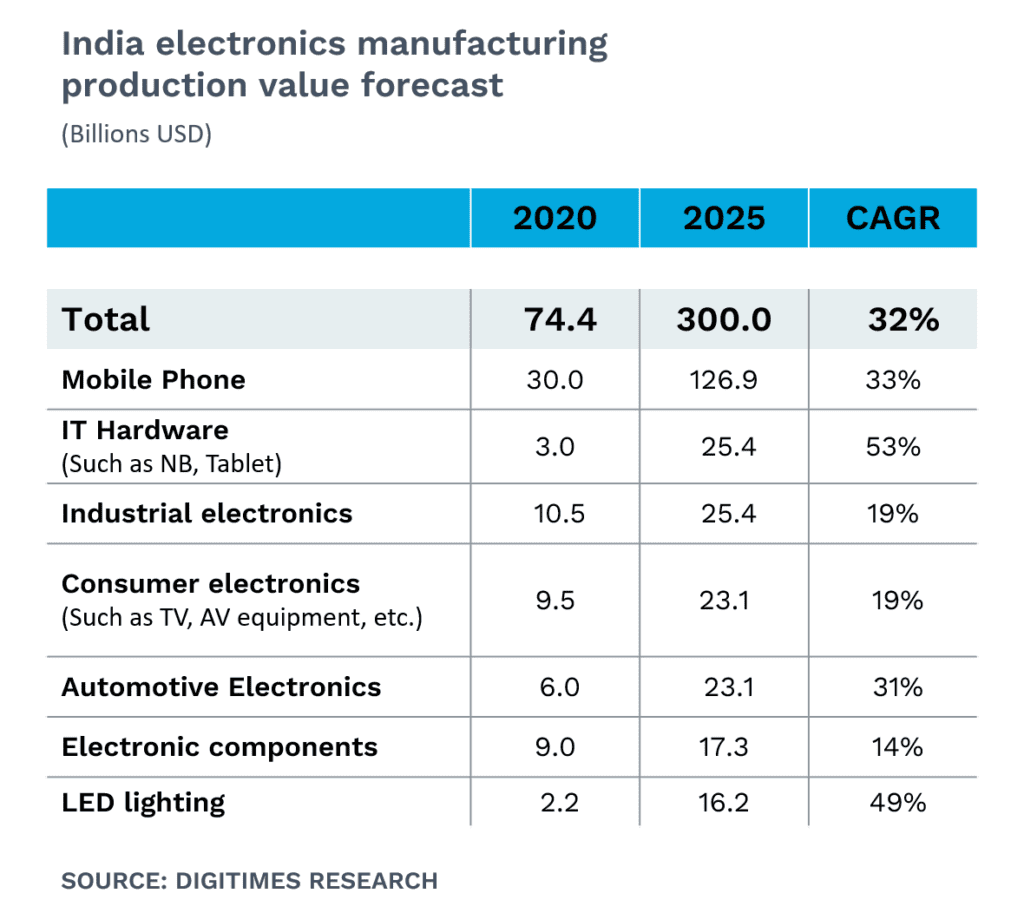

As a result of government incentives and potential domestic demand, the size of India’s electronics manufacturing industry will increase from $87 billion USD in 2022 to more than $300 billion USD in 2026, as reported by Digitimes. The country is now the second largest mobile phone manufacturer in the world (India Times).

Semiconductor Products

The Indian semiconductor market will grow from $27.2 billion USD in 2021 to $64 billion USD by 2026 – a CAGR of 19% (Indian Electronics and Semiconductor Association). Research by Digitimes predicts India’s share of the global semiconductor market will rise from 5% in 2021 to 10% in 2026.

Electric Vehicles

Thanks to the Indian government’s FAME initiative (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles), and the enormous local market for EVs, India has seen significant investments in EV manufacturing from local companies Mahindra and Tata, as well as overseas car manufacturers. The EV market in India is expected to grow from $3.21 billion USD in 2022 to $114 billion USD in 2029 – a 66.5% CAGR (Fortune). India is one of a handful of countries that support the global EV30 initiative to have at least 30% of vehicles sales be EVs by 2030.

Government programs to attract foreign investments

Government programs to attract foreign investments

The Indian government is putting big money behind its “Make in India” initiative, announced in 2014. There are many government programs focused on promoting consumer electronics, semiconductor and EV manufacturers. And they are working. For example, the electronics manufacturing market in India will grow 32% yearly through 2025.

That’s the good news.

The bad news is that, in India, there’s little integration between the national policymakers and state and provincial departments that actually enable factory start-ups. There are at least 7 local departments to go through – Including land allocation, utilities, environmental clearances, and labor. Each has its own lengthy application, review and approval process. The bureaucratic maze can be paralyzing.

Businesses new to India are largely oblivious to these requirements. They’re just excited about the opportunity, and the tantalizing incentive packages being offered.

It’s like being told there is a pot of gold on the opposite end of a field, but not being told about the booby traps scattered along the way.

So what do these companies do? They march forward enthusiastically with the goal of establishing their own manufacturing facility as soon as possible.

Some booby traps they avoid. Others they don’t.

When they don’t, projects can get delayed for months and months and customer commitments can be missed. It’ll take you 6-12 months to complete all the requirements to manufacture in India. Try to rush it and, ironically, it could take much longer.

Here’s a real example of what can go wrong if a company fails to plan effectively.

A high-tech component supplier signed a contract with a major cell phone manufacturer operating in India. Based on that order, the company moved quickly to set up operations in India. Many struggles ensued but, eventually, it began operating in a leased factory in India. Two years later, cell phone volumes contracted and the contract ended. Now, that company is stuck with a long-term lease and insufficient business to sustain operations. A better option for the company would have been to partner with an India-focused logistics company to quickly establish a Free Trade Warehousing Zone or bonded warehouse solution to store and distribute its products, while determining if it made prudent business sense to establish its own factory.

Patience is a virtue – in life and in business.

Understanding the legal, cultural and operational hurdles of doing business in India

India is a big economy with a big bureaucracy. Without the right guide, it’s easy to get lost in the administrative quicksand of state and provincial department, who are ultimately your ticket to starting business operations. Let’s look at just some of the things that can slow or stop your expansion to India.

CUSTOMS

Trade compliance rules are lengthy and complex, affecting the efficiency of the India supply chain. And they may be different depending on the incentive scheme you are applying for.

For Instance, a fully built electric vehicle and components that has an imported value above $40,000 will attract 100% duty, while a similar product that has a value below $40,000 will attract 60% Customs duty. If the EV is imported as a knocked-down kit (not mounted on a chassis or body assembly) containing all the necessary parts for assembling an EV in India, it will attract Customs duty of only 15%.

Trying to figure out these kinds of things on your own, from a foreign country, is daunting.

Here’s another example. Specific gateways into India specialize in certain commodities. In Chennai, for instance, all electronic, semiconductor, and mobile manufacturing products will move through Customs quickly because Customs officials there know the product types well. Engineering imports, on the other hand, might get delayed at the CFS or Air Cargo complex as Customs officials seek clarification.

LEGAL

Import licenses, export licenses, special operating certificates, registrations… You’ll need to understand what is required based on your operating model in India. Then you’ll need to complete the necessary paperwork and funnel it through the proper channels.

LOGISTICS

While India has the world’s largest population and one of the world’s largest economies, its logistics infrastructure ranks 38th in the world (World Bank Logistics Performance Index). Things are improving, but not fast enough. For instance, it’s not uncommon for the Indian government to establish an area as an economic zone, attract companies to invest, and only then clear the land and develop the surrounding roadways.

One thing is clear, you’ll want the right logistics partner to ensure you have the freight capacity to ship goods in and out, and the right warehousing and distribution solution. For example, a FTWZ/Customs bonded warehouse can help defer or avoid hundreds of thousands of dollars in duties and taxes. But there are different types of bonded warehouses, inside and outside of free trade zones. Which one makes sense for your business? It helps to have a knowledgeable guide to advise you appropriately.

CULTURE AND LANGUAGE

In India, the official language is Hindi, but less than 60% of the people can speak and understand it clearly. Each state has its own language and that can create barriers when trying to unravel a bureaucratic snafu over the phone from the U.S., or Singapore, or Hong Kong.

There are plenty of fluent English speakers, but they represent only 10% of the total population.

Let’s be clear. We mention these challenges not to discourage expansion to India. On the contrary, it’s a country with amazing advantages as a production hub – and as an end market for your products. You just need to frame a clear expansion strategy that allows your business to scale, while minimizing risk.

Next, we’ll explore a three-phase process to capitalize on all that India has to offer growth-minded businesses, while avoiding the pitfalls of a rushed, poorly planned strategy.

There’s a better way

Many factors are driving companies to expand production to India. But moving quickly isn’t the best, or sometimes even the fastest, way to accomplish this end goal. The infrastructure is still developing, the tax structure is complex, and India Customs has a different approach to assigning duty and valuations. Companies need time to assess the viability of the market and to understand the requirements of operating efficiently and economically.

The better path to establishing manufacturing in India is summarized in the accompanying graphic. It accomplishes your goal – full expansion to India – but without the downside risk of moving too quickly.

Next, let’s dive into the details of each phase so you have a good understanding of steps you can take.

1. Test the Market

No legal entity. Low risk. Bring in limited inventory and distribute from a free trade zone warehouse as you assess the viability of the market.

2. Create Trading Company

Create a legal subsidiary in India and do your own tax and compliance filings and issue domestic invoices. You can also operate via a virtual office or establish a nonlegal entity that operates out of a Free Trade Warehousing Zone.

3. Manufacture in India

Establish a factory in India and realize the full advantages of India’s incentive programs and large domestic market.

Test the Market

The first step would be to bring in a minimum amount of inventory to satisfy any existing clients and store it in a Free Trade Warehousing Zone (FTWZ). There is no need for importer or exporter licenses or to establish a legal entity in India. The licensee of the FTWZ can be the importer of record. Buyers of your products can file the bill of entry with India customs and take possession of the goods.

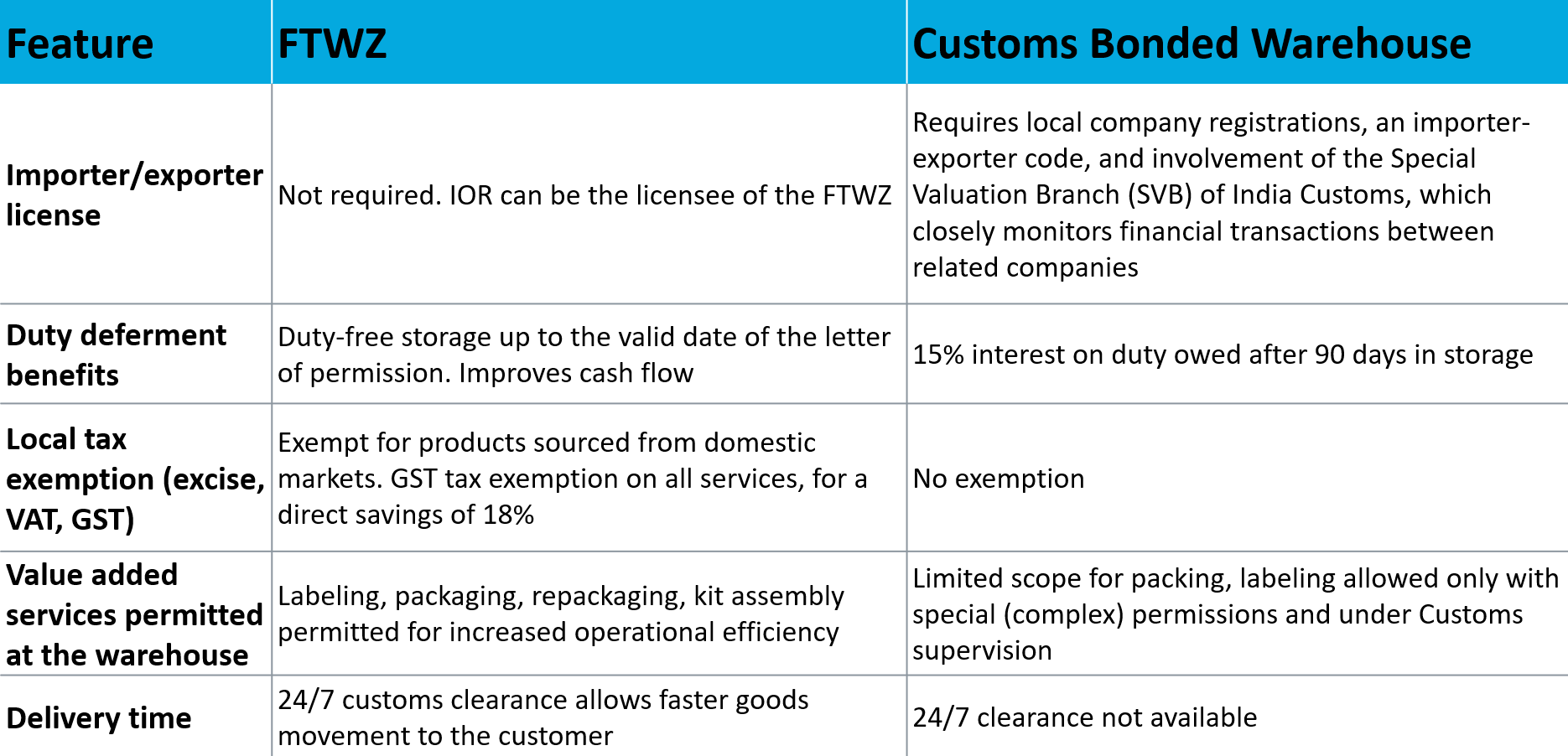

Inventory can be stored, duty free, for 2 years, and FTWZs offer 24/7 customs clearance for faster movement of goods to buyers. Check out the full advantages of an FTWZ in the accompanying chart, as compared to a Customs Bonded Warehouse.

FTWZs offer a low risk but very effective way to “test” market interest in your product, while at the same time learning the basics of doing business in India.

FTWZ vs Regular Bonded Warehouse

Create a trading company

Once you’ve determined that India is a viable market for your products and you wish to expand, you can take the next step toward full-fledged manufacturing in India: creating a trading company.

In this model, you establish a legal entity in India – a subsidiary of your parent company – without needing to establish a physical presence. You are essentially trading with yourself, from parent to subsidiary. The local company then sells and supplies goods to buyers. Customer communication and service tends to be faster and better through this local trading company, as buyers interact directly with members of your team.

Operationally, this phase of India expansion can happen under another Indian government program that allows you to conduct manufacturing operations outside the traditional factory setting in a bonded warehouse for manufacturing. Both component parts and capital equipment can be imported – duty free or with minimum duty bond payout – until goods are sold domestically. If components are used to create finished goods that are then exported, the deferred duty is exempted.

The MOOWR (Manufacturing & Other Operations in Warehouse) Scheme primarily aims to make it easier for electronics companies to manufacture in India. Some logistics partners, like Dimerco, can help global companies obtain a MOOWR warehouse license and offer solutions for bonded warehouse manufacturing.

Despite the many tax advantages of the MOOWR program, widespread adoption is limited because of the lack of clarity around the program’s legal and tax aspects . The right logistics partner can help you understand and access this beneficial program.

A Dimerco success story

For a Taiwan-based electronics company that wanted to operate in India but was not ready to set up its own factory, Dimerco established a customs bonded warehouse in India, allowing the company to defer duties until the final sale. Dimerco managed the shipment of products into India from the company’s manufacturing plants in Hong Kong, Mainland China and Taiwan. But more importantly, the legal and compliance team of the company’s logistics partner in India, Dimerco Express Group, helped the company stay compliant with all local and national regulations and, ultimately, expedited its expansion into India.

Manufacturer in India

Once you’ve done initial testing and then truly proven the long-term viability of the Indian market through a trading company, the final step is establishing a factory in India. Companies that move immediately to this stage are often surprised by the difficulties they encounter at the regional and local level.

Here’s why.

Early on, these companies interact primarily with business-friendly federal agencies enthusiastic to welcome them to India – and offering attractive financial incentives. But while these federal agencies administer PLI, SPECS, MOOWR and other incentive schemes, they do not oversee the local agencies that grant the approvals to buy land, operate a facility, access utilities, and hire people.

You’ll need approval from 6 or 7 agencies before you get the “all clear” to operate.

India is not a whole lot different in this respect. Local municipalities in any country will have standards to meet, licenses to acquire, and processes to follow. The point is that all of these administrative requirements take time, patience and, ideally, some advice from a local logistics provider or consultant that knows the ropes.

By taking the three-phase approach we’ve outlined, the first 2 phases can be used to fully understand all of the eventual requirements and begin the process for applying for and obtaining necessary licenses and certificates. While you are doing that, your market expansion is not stalled as you wait for the wheels of bureaucracy to slowly turn. You’re actually selling goods, building a customer base in India, and learning how business, customs and logistics are done here.

As a result, when you do begin production in India, the process will go much faster and smoother because shipping routes and partners have been figured out, customs processes have been mastered, and all the necessary licenses and paperwork have been completed.

The right partner can speed your expansion to India

If you’ve read this far, it’s a good bet you’re not part of a very large, multinational company. Those companies have legal and compliance departments whose job it is to figure out and solve the challenges we’ve outlined. It’s the small and mid-sized companies that struggle the most because these organizations simply don’t have the time required to understand the requirements and coordinate compliance.

Luckily for them, there are people who do.

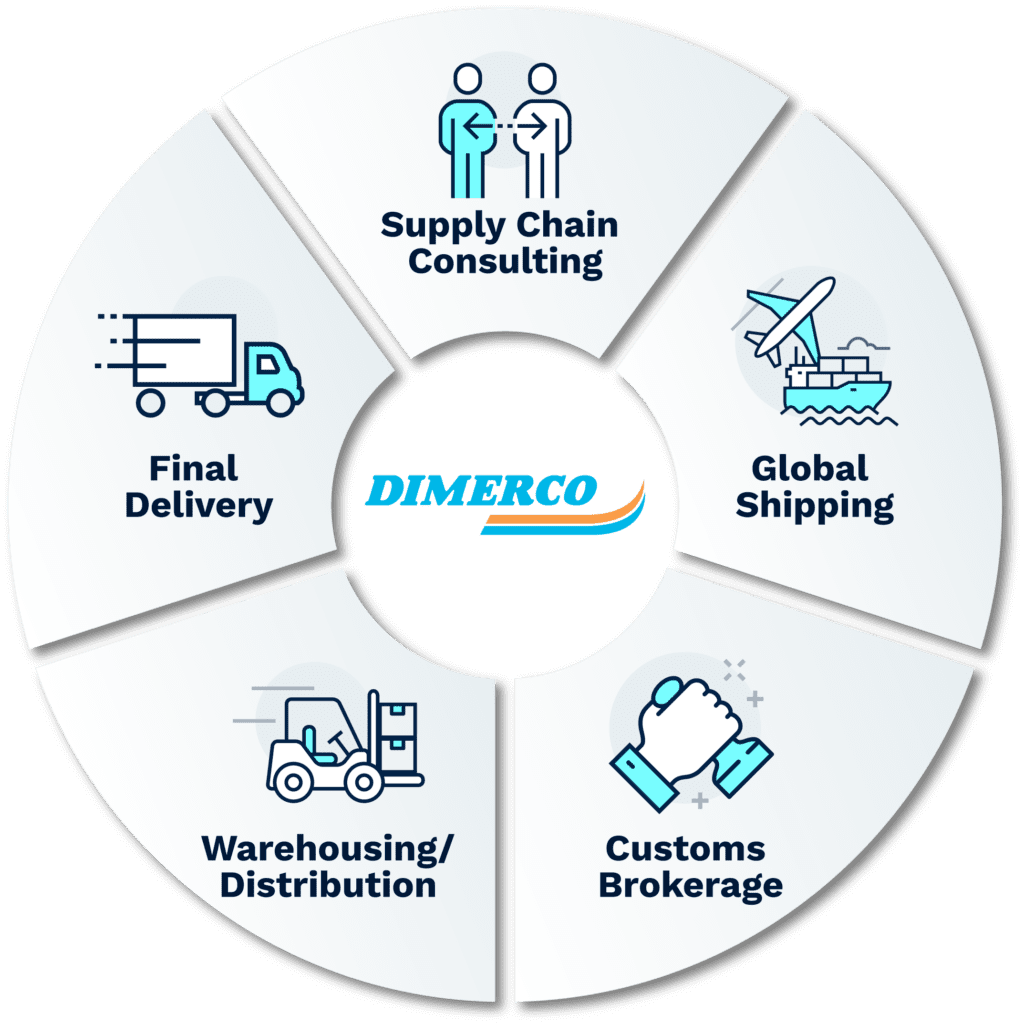

Most large management consulting firms offer full-service relocation consulting, but beware. Often their expertise is limited to overcoming government hurdles. At the end of the day, you’ll need to not only navigate the bureaucracy but also ship, store and distribute your goods. Some logistics firms in India, like Dimerco, can help you with both as part of an integrated solution for market entry.

Here are some of the things to look for when choosing an advisor for your Indian expansion project:

- Knowledge of the incentive and tax deferral schemes available. The schemes can get quite specialized and it’s not always easy to know which one suits you best.

- Ability to help set up a company – with assistance from a certified CPA firm.

- Help registering with various government departments.

- Good understanding of India’s Customs processes and how they differ from port to port. You don’t want an academic understanding here. Choose a partner that works with India Customs every day.

- Experience with Customs duty payment management. This includes Customs bookkeeping and rack management for debit/credit with India Customs departments, including annual filing and audit representations.

- Fluency in your chosen language. Understanding trade and tax compliance is complicated enough in your native tongue; it’s doubly hard in another language. Find a partner with a knowledgeable staff member that speaks your language.

The economic advantages of expansion to India can be enormous. It pays to invest in the right guide to ensure a timely, trouble-free expansion project.

MADE IN INDIA: Making it Happen

India represents an enormous opportunity for growthminded businesses – particularly those in electronics, electric vehicles, and other advanced manufacturing industries.

But beware of moving too quickly to capitalize on India’s benefits as a production hub. Establishing operations here can be complex. If your expansion strategy is not well-planned, you risk significant delays and unhappy customers.

So push on with your India expansion plans, but do so judiciously and with the help of a knowledgeable logistics partner that knows the market and has significant experience supporting international expansion initiatives.