Home »

The EV Supply Chain Challenge

Contents

EV Market’s Rapid Growth

Transformative Change

New Players Emerge

New Markets Emerge

New Partners Needed

- The Best 3PLs for the EV Supply Chain

- New production hubs and shipping lanes

- Different parts, new players

- New markets

Selecting a 3PL To Support Your EV Supply Chain

Managing This Decade’s Biggest Production Challenge

A review of the logistics challenges of electric vehicle production and how OEMs and suppliers must adapt

The electric vehicle (EV) market is growing faster than the ability of supply chains to keep up

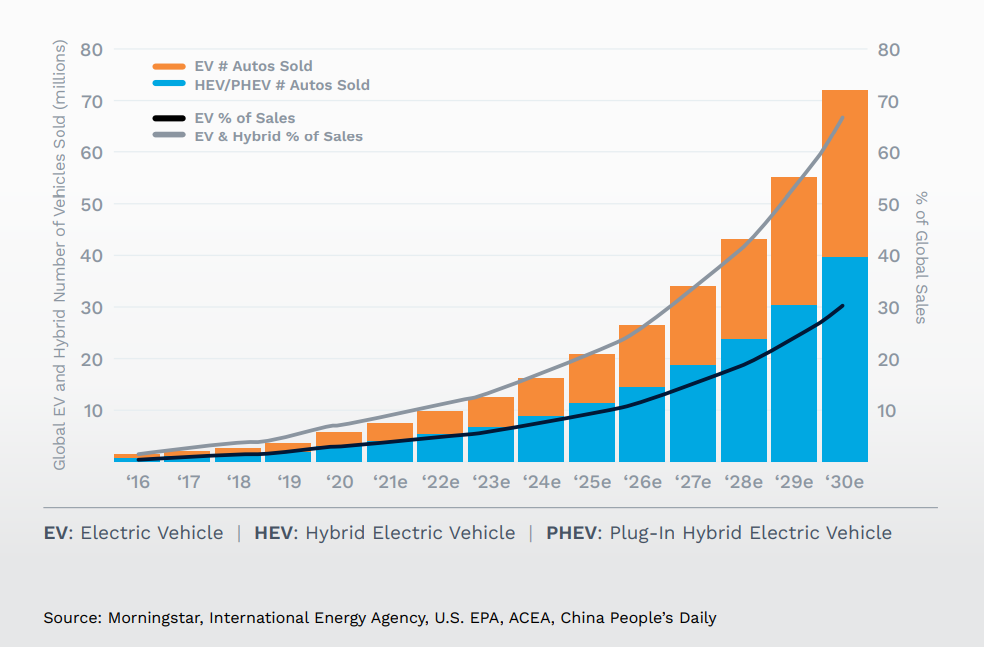

Global EV sales will go from around 2 million in 2020 to about 73 million in 2040 (Goldman Sachs Research). By 2030, EVs and hybrids will be 66% of new car sales, globally.

A slew of car makers and component suppliers – from traditional auto giants like Volkswagen and General Motors to newer, EV-focused brands like Tesla and BYD Auto – are racing to capitalize on exploding market demand. But what they must recognize is that EV supply chains are vastly different from traditional automotive supply chains, and the logistics strategies they’ve employed for years may not apply.

For decades, metals, plastics and parts required to make gas-powered vehicles flowed through finely tuned supply chains that, today, have been turned upside down.

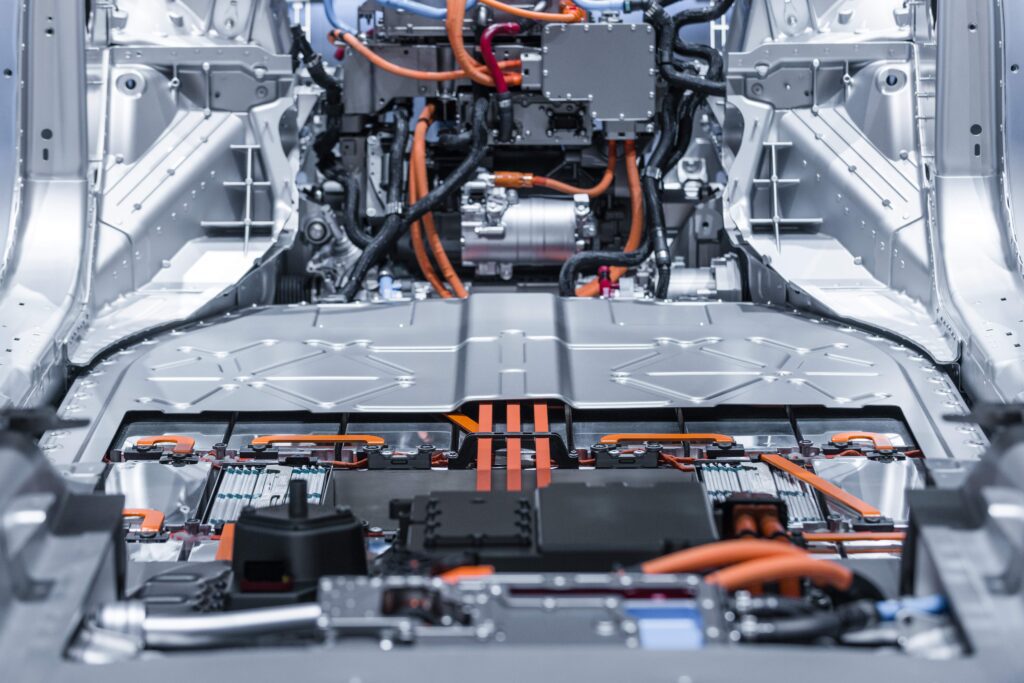

Semiconductor parts, which make up a much larger percent of EVs, are very sensitive and must be handled and shipped differently.

The chips and batteries so central to EVs will ship largely from Asia on new shipping lanes, and that could require different global shipping strategies and partnerships.

OEMs and suppliers will need to establish operations in emerging markets for EV production, like India and Thailand. This will require companies to quickly adapt to new warehousing, shipping and regulatory requirements, as well as a new language and culture.

The opportunities for growth in the EV market are enormous. For supply chain professionals, supporting this growth will require new skills and the right logistics partners. This eBook is about how electric vehicle OEMs and their suppliers must rethink how they manage logistics operations to meet the requirements of this decade’s biggest production challenge.

Download Guide

If you prefer to download this article as a PDF, just complete the form. Otherwise, keep reading.

Transformative change is happening

As the auto industry transforms from internal combustion engines (ICEs) to battery-electric vehicles, the supply chain shift required to build these new vehicles has not been smooth.

One reason is the increased use of semiconductor chips in EVs versus ICEs.

2010 |

ICE vehicles used 600 chips |

2021 |

ICE vehicles used 1,200 chips |

2022 |

EVs used 2,700 chips |

Sources: Wall Street Journal and IDTechEx

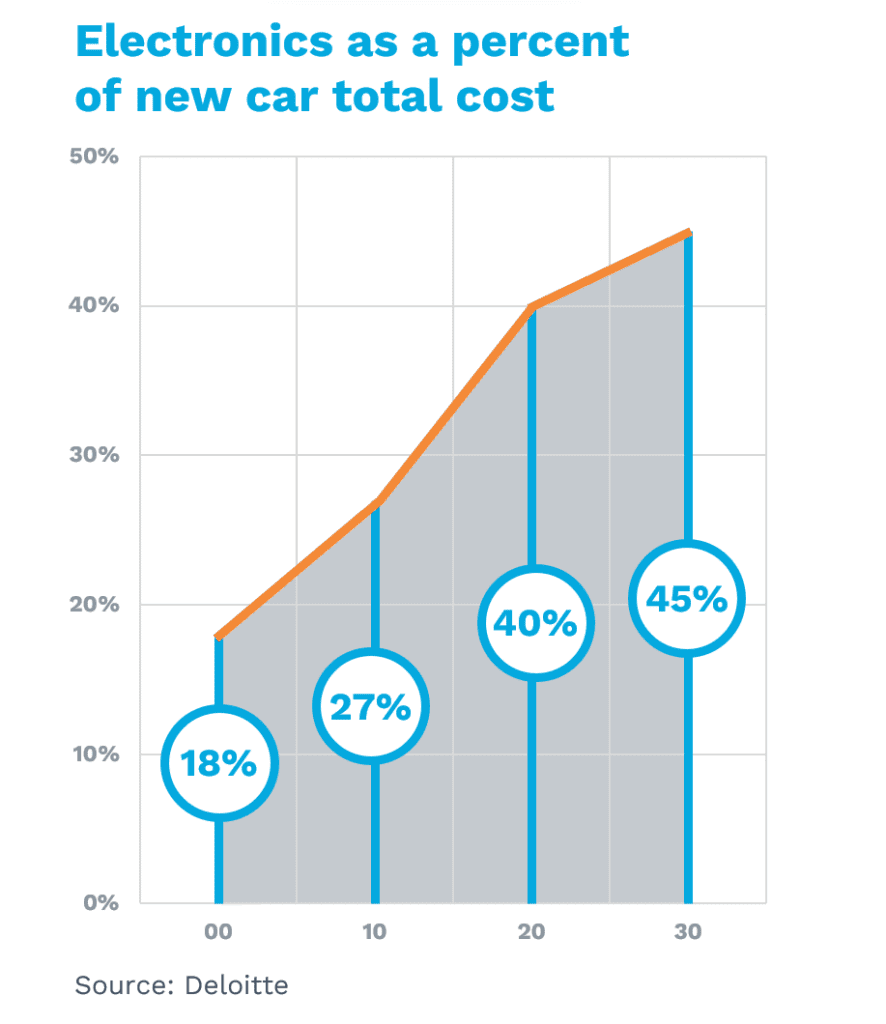

Electronics as a percent of new car cost will go from 18% in 2000 to 45% in 2030 (Deloitte)

In the past, the big automakers called the shots with a “take it or leave it” attitude toward suppliers, who were expected to deliver high-quality, innovative products while continually reducing costs.

But the semiconductor shortage triggered by COVID changed the power dynamics. Car makers couldn’t source vital semiconductors at any price and acres of unfinished vehicles clogged production facilities around the world. The automotive industry lost more than $200 billion in 2021 (CNBC) and 11 million fewer vehicles were produced (Motortrend).

After this wake-up call, automakers recognized that they did not understand the semiconductor supply chain and began a panicked exploration of how to source the needed chips – before their chip-hungry competitors.

To maintain production levels, OEM and component manufacturers simply must develop a reliable and resilient inbound supply chain for semiconductor products – chips that will mostly come from Asia, the hub of global semiconductor manufacturing. And they’ll need to align with the right carriers and logistics partners to keep these new supply lines flowing.

New players emerge

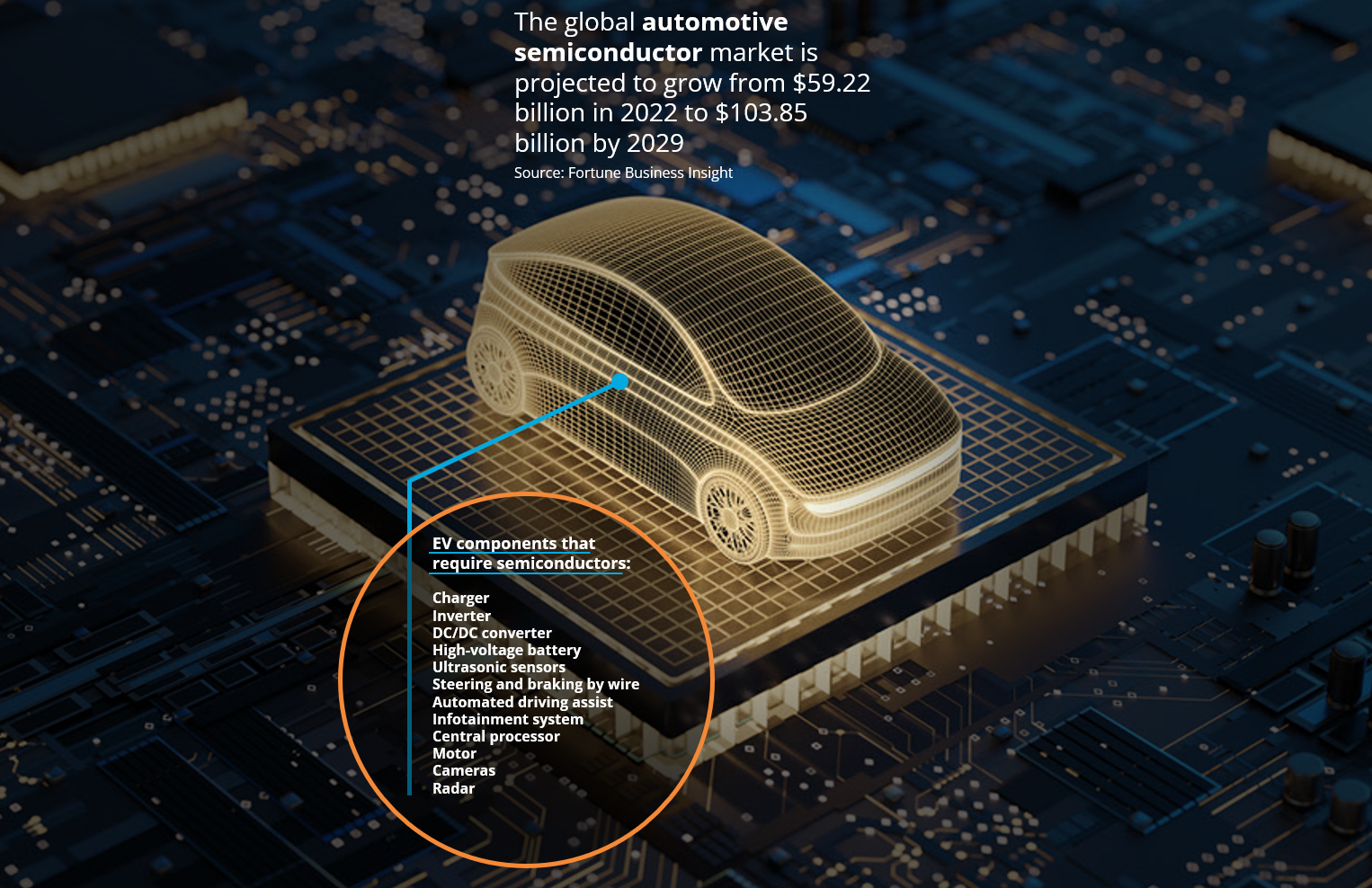

As cars become even more like computers on wheels, semiconductor and battery companies have taken on starring roles in automotive supply chains.

Batteries make up as much as 25% of the vehicle’s overall weight and up to 50% of its cost. Semiconductor content per electronic vehicle is 2.3x that of ICE cars and growing (IDTechEx). This is fueling tremendous growth in the global automotive semiconductor market.

The accompanying visual shows just some of the EV components that require semiconductors.

Tech companies that have not focused on the automotive market have new opportunities to participate. According to Mordor Intelligence, the top electric vehicles semiconductor device market leaders are:

- Infineon Technologies

- STMicroelectronics

- NXP Semiconductors

- Texas Instruments

- Renesas Electronic

These companies and others like them are the new linchpins of auto supply chains.

Bottom line: the value chain of the automobile manufacturing industry has completely shifted – from the raw materials and infrastructure to build the engine and body to the research and development for software, sensors, batteries, and motors.

New markets emerge

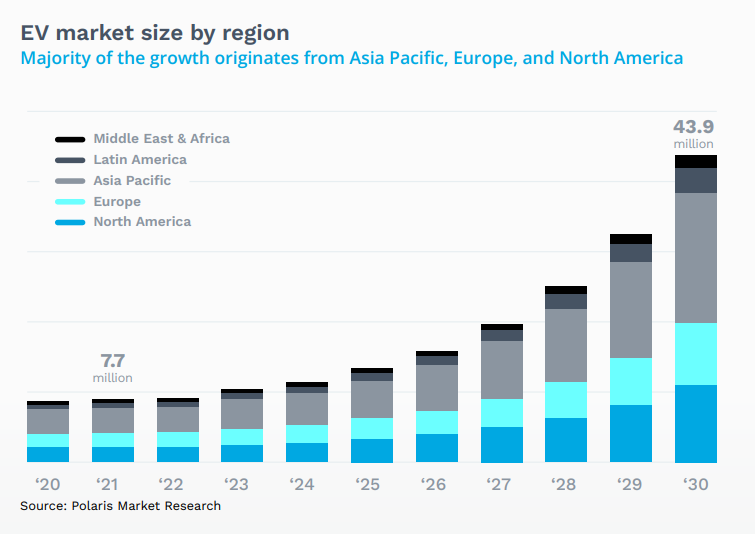

Currently, three markets dominate electric car sales: China, Europe and the United States. But China is clearly the world leader in making and buying EVs with 60% of global electric car sales (International Energy Agency).

But that dominance is declining.

ASEAN countries and India will become the central hubs for EV production through 2030

Source: DIGITIMES Research

DIGITIMES research on EV supply chains concludes that ASEAN countries and India will become central hubs for EV production – with Thailand, Indonesia and India leading the way in terms of growth. That changing geographic landscape will have major ramifications for how and where goods are transported, as automotive supply lines take on even more of an Asian flavor.

Following is a summary of how new markets are positioned to play a larger role in both the production and consumption of EVs over the next decade.

India

India will command a larger market share for EVs over the next 10 years, primarily from two- and three-wheel vehicles. Thanks to the Indian government’s FAME initiative (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles), and the enormous local market for EVs, India has seen significant investments in EV manufacturing from local companies Mahindra and Tata, as well as overseas car manufacturers. Amazingly, the EV market in India is expected to grow from $3.21 billion USD in 2022 to $114 billion USD in 2029 – a 66.5% CAGR (Fortune).

Indonesia

Indonesia has abundant mineral resources, including nickel and cobalt required for EV battery production. The country has successfully attracted car battery giants to invest, including LGES from South Korea and CATL from China. Indonesia is expected to become a car battery manufacturing center for the ASEAN region. The Indonesian government is also actively lobbying international automakers to set up EV production lines in Indonesia, attempting to extend its industry downstream. Currently, both Hyundai (South Korea) and SAIC (China) have set up EV factories in Indonesia.

Taiwan

As the epicenter of the global semiconductor manufacturing industry, Taiwan has become a strategically important supply source for chip-hungry EV manufacturers. In addition, Taiwanese contract manufacturers like Foxconn and Pegatron that were not traditionally focused on the auto industry are expanding into this high-growth market.

Thailand

Thailand is known as the “Detroit of the East” and has become the main production base for electric vehicles in ASEAN, attracting investment from manufacturers from China and elsewhere. Thailand is expected to become the most important EV production center among the 10 ASEAN countries. Among these countries, the Thai government has the most complete incentives for the manufacture and purchase of electric vehicles. Under a bilateral trade agreement, Chinese pure electric vehicle exports to Thailand enjoy a 0% tariff, promoting popular Chinese electric vehicle models such as Great Wall Motors (GWM), BYD, SAIC, and NETA in Thailand.

Vietnam

Vietnam shares a border with China and has been a prime location as part of the China Plus One strategy for Western and Chinese firms. Vietnam is investing in its logistics infrastructure to extend its growing role as a manufacturing hub for a range of industries, including automotive.

One of the reasons India and ASEAN countries are emerging as EV-making hubs is the size of their consumer markets and the fact that car ownership relative to population is small. The market opportunity for EVs is huge in these countries.

Let’s not forget Mexico

While EV supply chains will increasingly run through Asia-Pac, Mexico’s role is growing as well. Foxconn, the world’s largest contract electronics manufacturer, has established a hub in Mexico with the goal of serving North American clients. Pegatron, another contract assembler, is following suit. Tesla has announced plans to relocate its Berlin Gigawatt factory to make batteries and EVs in Mexico.

These emerging EV production hubs are changing the face of automotive supply chains. OEMs and component manufacturers must recalibrate sourcing and logistics strategies to address a more Asia-centric map.

New partners needed to support changing logistics strategies

As EV supply chains evolve, they create new shipping and logistics challenges.

New shipping lanes require reliable freight capacity in these lanes.

Important products like semiconductor chips and EV batteries require special handling.

Expansion into new markets requires knowledge of how to establish operations in these countries – from compliance with local regulations to hiring and managing a labor force.

These new challenges create a need for new logistics partners better positioned to help. Following are some critical logistics implications of changing EV supply chains.

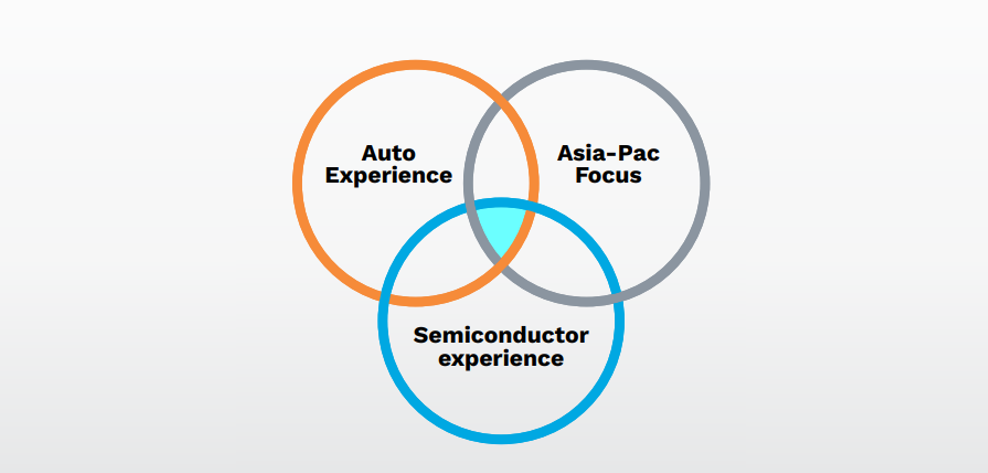

The Best 3PLs for the EV Supply Chain will need a combination of experience

New production hubs and shipping lanes

New EV supply chains will require more shipping to, from and within Asia, requiring logistics partners to move freight reliably and affordably in these lanes.

You’ll need freight forwarders with strong relationships with regional carriers and the ability to get you the freight capacity you need, particularly when capacity is tight.

While great freight service in Asia will be key, shipping partners will need to be

global to connect with North America, Europe and other world markets. Example: When a Chinese car parts maker had to support a major customer’s new operation in Texas, Dimerco Express developed a solution that included shipping from China to Houston, trucking from Houston to South Texas, and warehousing services to feed parts, just in time, to the assembly line.

Different parts, new players

The drivetrain of an ICE vehicle can have more than 200 moving parts, compared to 17 or so for a Tesla. But although EVs have fewer parts, the components, such as semiconductors, batteries and drive systems, are more challenging to ship and store.

EV batteries are shipped as” dangerous goods” and are subject to many rules, regulations and restrictions.

Automakers have a near-zero tolerance for quality defects in component parts because one faulty part can become front page news. During the distribution process, it’s much easier to damage a chip than a spark plug or brake pad. That’s why it’s critical to work with logistics partners that have experience handling semiconductors, batteries and other sensitive parts.

New markets

As EV production hubs expand from China into India and ASEAN countries, component manufacturers will need to set up operations in new countries. Do not underestimate the complexity of entering new markets and the time it takes to do it right. Questions to ask:

- Will I have the freight capacity I need?

- Is sufficient skilled labor available?

- Is sufficient warehouse space and local transportation available?’

- What licenses or permits are required to comply with country and local regulations?

- Might customs requirements be more

complex and create delays?

It helps to work with a logistics partner that already operates in the new market and has local market know-how to make your market expansion faster and easier.

Selecting a 3PL to support your EV supply chain

As you position your company to capitalize on the explosive growth of EVs, it’s important to get the logistics right. That includes identifying the right 3PL partners to help. That could mean expanding the role of an existing 3PL or building new partnerships with better-fit providers.

Here are the things EV OEMs and suppliers should look for in a logistics partner:

- Strong presence across Asia, particularly India and ASEANmember countries. A 3PL that has operated in a market for years can help with legal and regulatory requirements associated with entering a new market, as well as moving goods seamlessly through Customs.

- Freight capacity. You want a partner with the freight buying power to source the capacity you need.

- Local warehousing. A 3PL with local facilities can help you enter markets quickly. Bonded warehouses can help defer duties and taxes to improve your cash flow.

- Experience shipping semiconductors and batteries. This experience reduces the risk in shipping these sensitive specialty products.

- Global scope. EV supply chains are global, requiring logistics partners that can connect OEMs, suppliers and customers on multiple continents.

- Green-conscious operating model. Auto industry companies are among the leaders in CO2 reduction strategies. It’s important to have logistics partners that support these goals. Example: Dimerco provides China-to-Europe rail service to a car parts company that prefers a green-friendly alternative to air and ocean transport.

- Strong systems. You’ll want real-time visibility to your inventory and shipment status, globally, along with a platform for supply chain partners to manage orders and shipping activities to the Purchase Order level. Many 3PLs claim to have this capability, but few actually deliver on it.

Managing this decade’s biggest production challenge

Consumers will spend hundreds of billions of dollars on EVs through 2030 – either because they want to or because government EV mandates won’t leave them any choice. Satisfying the global demand for EVs over this time will be one of the biggest production challenges the world has ever seen.

It’s going to be a wild ride, and logistics professionals at OEMs and suppliers will be right in the middle of it – holding on with both hands.

Success or failure will hinge largely on your ability to manage a supply chain that is vastly different from that of traditional combustion engine vehicles.

The good news is that help is available. But you’ll need the right kind of 3PL partner. One with the experience to store and ship new components on new shipping lanes to new countries – all to meet production schedules that will get faster and faster as government EV mandates kick in.

Like we said, it’s going to be a wild ride.